Travel Insurance

Whether travelling for business or leisure, Travel Insurance is an essential purchase giving peace of mind when away from home. In an ever-changing political climate, visa controls and government regulations place increasingly stringent and often confusing requirements on the traveler, making a comprehensive travel policy as important as the travel planning itself.

Travel insurance is generally intended to cover emergency medical expenses and other losses incurred whilst or occasioning from travelling. Travel may be either within the Insured’s own country or internationally. ‘Single Trip’ policies can be arranged at any time prior to journey commencement and are typically purchased at the time of booking travel arrangements, with cover being arranged for the intended duration of that trip. Alternatively, and often most cost-effectively, a “multi-trip” policy may be arranged which provides cover for an unlimited number of trips within a set time frame (typically annually).

Greater House offers a range of Travel products for individuals and families both travelling to or from the UAE, with a choice of plans to suit their respective needs. Our policies protect the modern traveller against most the most commonly occurring risks with covers such as payment towards emergency medical treatment, emergency evacuation, repatriation of mortal remains, telephone medical advice and delivery of essential medicines, trip cancellation, lost baggage, legal assistance and personal accident benefits. Our standard Policy offers such essentials with the flexibility to purchase ‘top-up’ additional coverage to meet individual circumstances (note that whilst we seek to cover all eventualities, in line with usual market practice we do not include personal accident, injury or liability connected to winter sports or pre-existing medical conditions).

Our process

Step 1: Receive and Evaluate

Step 2: Analysis and Planning

Step 3: Make plans and Implement

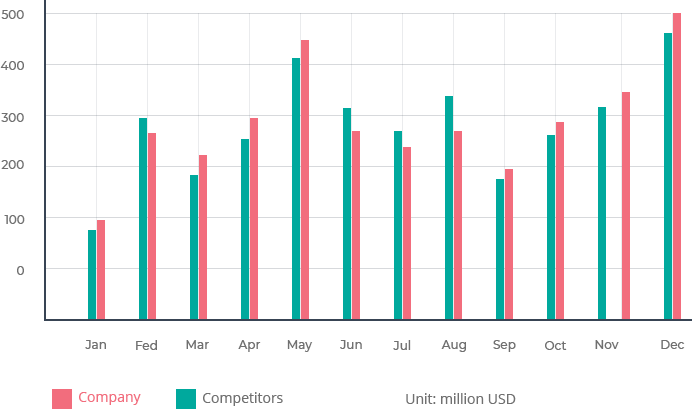

Analysis charts and statistics