Life Insurance

Life insurance or life assurance is cover provided by an insurer where the insurer promises to pay a designated beneficiary a sum of money (the “benefits”) upon the death of the insured person. Depending on the contract, other events such as terminal illness or critical illness may also trigger payment. The policyholder typically pays a premium, either regularly or as a lump sum.

Life policies are legal contracts and the terms of the contract describe the limitations of the insured events. Specific exclusions are often written into the contract to limit the liability of the insurer; common examples are claims relating to suicide, fraud, war, riot and civil commotion.

Life insurance tends to fall into two major categories:

Protection policies – designed to provide a benefit to cover a specified event, typically a lump sum payment. A common form of this design is term insurance and it can be a temporary cover as it is limited to the occurrence of a triggering incident during the period of cover.

Investment policies – where the main objective is to facilitate the growth of savings by investing on a regular or lump sum premium basis in various investment vehicles to generate returns based on the risk appetite of the policyholder.

Whether a client is looking for protection or an investment to provide for future generations, Greater House is able to cover most eventualities and with our transparent approach and working closely with clients, is able to offer products and services that meet or exceed customer needs and expectations.

Our process

Step 1: Receive and Evaluate

Step 2: Analysis and Planning

Step 3: Make plans and Implement

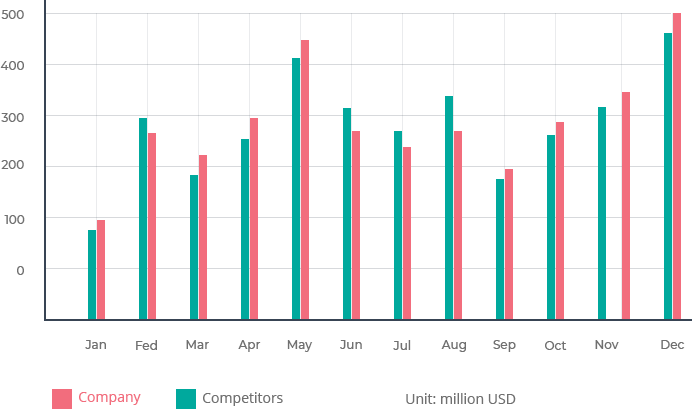

Analysis charts and statistics